10 Pre-Retirement Planning Keys

Retirement is a significant life milestone that marks the end of a long and fulfilling career. It is a time when individuals transition from working life to a period of leisure, pursuing personal interests, and enjoying the fruits of their labor. Preparing for retirement can be a daunting task, requiring careful planning and foresight to ensure financial stability and a comfortable lifestyle. Below, we will discuss the pre-retirement keys to success, outlining the critical steps individuals can take to help maximize their retirement years and strive to achieve financial success.

- Keep a monthly budget and cash flow tracker

- Establish an emergency account of 3 to 6 months of fixed expenses (mortgage/rent, car payments, utilities, etc.)

- Pay off high interest debt that is above 6%

- Establish and prioritize your savings order and debt payoff Establish emergency savings account (3-6 months of expenses)

- Consider maximizing your full employer match (if match is 5%, start with a 5% savings)

- Regarding your employer retirement accounts (401k, Roth 401k, 403b, etc.) ii. This is considered “free money” from your employer\

- Pay down high interest loans (over 6%)

- Consider maximizing the rest of your 401k contribution amount (Up to $23,500 for 2025)

- If you are 50 or older you can contribute $31,000/yr in 2025 (Catch up)

- Utilize a Health Savings Account (HSA) (2025 -> Family $8,550/ Single $4,300) and/ or Flexible Spending Account

- Make sure your HSA is INVESTED and taking advantage of potential market growth

- If you pay out of pocket and collect receipts, you can submit them at any time for a reimbursement – there is no time limit or deadline

- HSA contributions roll over to the next year, whereas FSA expires at the end of each year

- Save towards a non-qualified investment account (Brokerage, Individual, Joint, Trusts, etc.)

- There is a constant debate where this lands in the savings order

- Since this account is always available and “liquid” we ideally want to be able to add money to this account each year to save up for short to mid term goals (new car, home, big vacation, education expenses, etc.)

- Consider maximizing annual IRA contribution of $7,000 (2025) towards a Traditional IRA, Roth IRA (2025 -> Single: Modified AGI is <$150,000 ; MFJ: Modified AGI is <$236,000), or a backdoor Roth IRA if income is above the previous amounts

- Establish systematic contributions (SAVE!) for 401k and taxable accounts

- Analyze 401k investment options, make sure you are taking full advantage of company match, vesting periods, and Roth 401k options.

- If you are in the 24% bracket or lower, we highly recommend utilizing a Roth 401k throughout pre-retirement

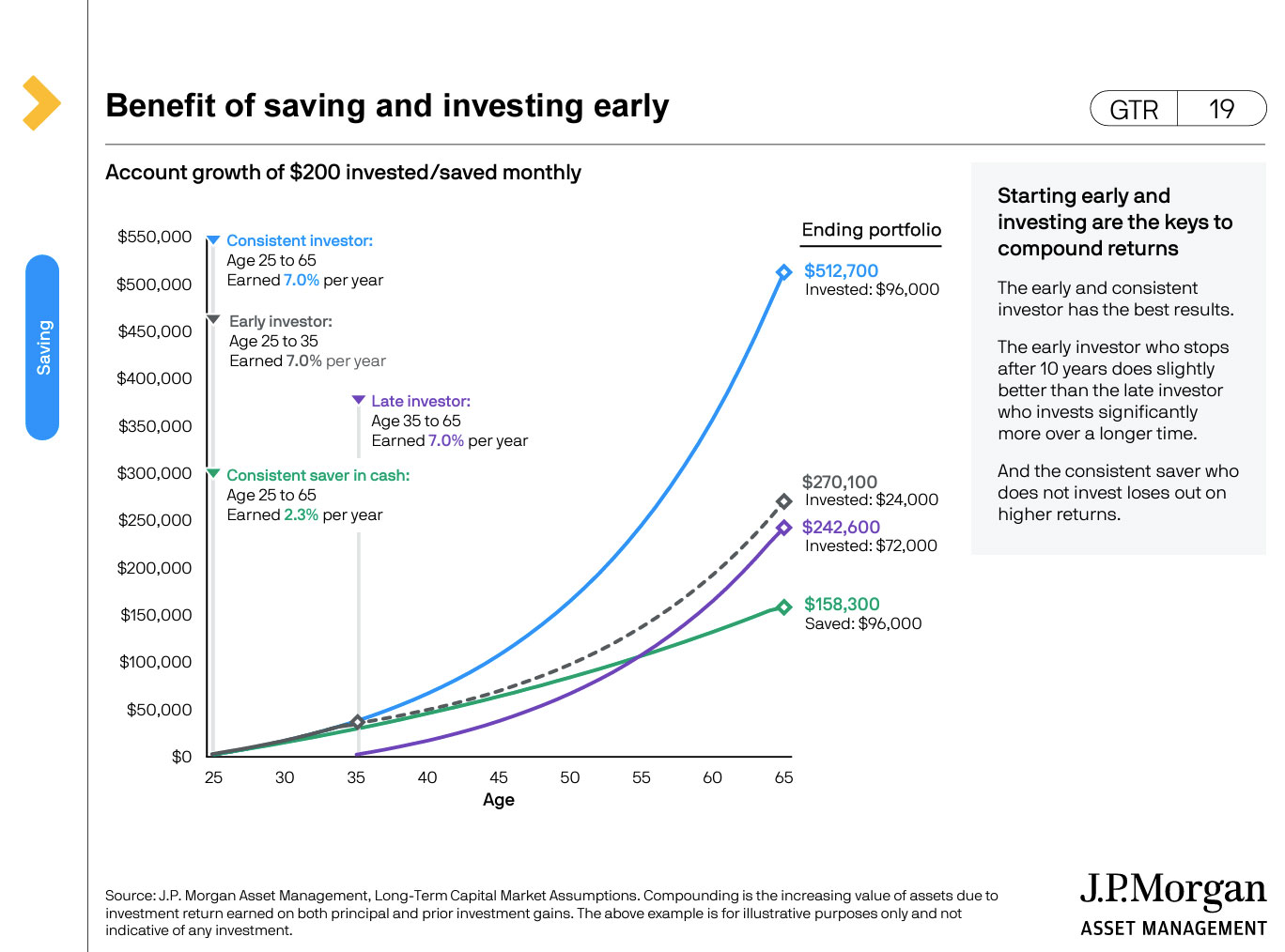

- *Compound growth is the primary driver for a successful retirement – it is about time in the market, not timing the market.

- Keep an aggressive investment allocation

- When you are below 50 favor passive investments, keep investment cost low, and let it ride the market

- Make sure your estate documents are in order if you are married or have a child

- It is essential to have a Will, Durable Power of Attorney for Financial Affairs, Durable Power of Attorney for Medical Affairs, Living Trust, and Living Will

- We recommend updating these documents every 5 years

- Establish 529 Education Savings account for your kids early and ask parents / grandparents to help

- Analyze if it makes sense to do a Back Door Roth IRA contribution or Roth Conversion during years you have excess cash or income is low

- If you have an existing Traditional IRA from an old 401k rollover (previous employer) – it could make sense to start the Roth Conversion with today’s current tax rates leading up to retirement

- We want to avoid the retirement tax bomb when Required Minimum Distributions (RMD) kick in

- Stay educated and keep up a general market understanding

- Keep a long-term, consistent outlook

In conclusion, preparing for retirement requires careful planning and execution. By setting clear goals, creating a retirement budget, paying off debt, saving for retirement, diversifying your investments, considering healthcare costs, developing a retirement income strategy, and staying active and engaged, you can help maximize your retirement years and seek to achieve financial success.

We strongly encourage sharing this with children, grandchildren, other family members, and friends you think this can be benefit.

If you have any questions, please do not hesitate to reach out!

Written by:

Corey Briggs, CFP®, CIMA®, CEPA Wealth Manager

cbriggs@plazaadvisors.com

101 S. Hanley Road, Suite 1350

St. Louis, MO 63105

314-726-0600 www.plazaadvisors.com

The information and analysis are provided solely for discussion, educational and informational purposes, should not be relied upon when making any decisions and IS NOT legal or tax advice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. All clients must consult with their own tax and legal advisors regarding the information and analysis provided and should do so prior to making any decisions or taking any actions to ensure that the actions are appropriate for their particular situation.

There is no attorney-client relationship established by providing the information and analysis in this document or any related communications and conversations whether written or oral.

Diversification does not assure a profit or protect against loss in a declining market. Past Performance is no guarantee of future results.

Conversions from IRA to Roth may be subject to its own five-year holding period. Unless specific criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals of contributions along with any earnings are permitted. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion.

Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information.

Steward Partners Investment Solutions, LLC (“Steward Partners”), its affiliates and Steward Partners Wealth Managers do not provide tax or legal advice. You should consult with your tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Securities are offered through Steward Partners Investment Solutions, LLC (“SPIS”), registered broker/dealer, member FINRA/ SIPC. Investment advisory services are offered through Steward Partners Investment Advisory, LLC (“SPIA”), an SEC-registered investment adviser. SPIS, SPIA, and Steward Partners Global Advisory, LLC are affiliates and collectively referred to as Steward Partners.

Representatives of The Briggs Group at Plaza Advisory are registered with and provide securities and/or advisory services through Steward Partners.

AdTrax 5508385.2 Exp 12/25